Dream of owning your own home?

Connect with the information and resources you need to plan and achieve it

People and families with disabilities who dream of owning their own home can connect with a Movin’ Out HUD-certified housing counselor for help building a foundation of knowledge, documenting home ownership goals and strategies, and crafting a tailored housing plan. Our housing counseling program has adopted the National Industry Standards for Homeownership Education and Counseling. Empowered with a step-by-step plan, first-time income-eligible home buyers may qualify for down payment assistance grants or loans to achieve their home ownership goals.

For current homeowners, Movin’ Out housing counselors provide housing counseling and access to resources for home repair and improvements for safety and accessibility.

We also offer housing counseling, information, and planning help for people seeking to rent a home.

Contact a housing counselor

Housing counselors welcome your questions. Anyone needing information or referrals, people with disabilities and their allies, family members, service providers, care managers, or support brokers can contact us.

To reach a Movin’ Out housing counselor, call (608) 251-4446, extension 7, or toll free (877) 861-6746, extension 7.

If you need accommodation for a hearing or speech impairment, please dial 7-1-1 to connect to Telephone Relay Services (TRS) from any phone. TRS will then connect you to Movin’ Out at (608) 251-4446.

You can also email us at: info@movin-out.org.

Home Ownership

Achieving affordability and reducing the financial risks of home ownership

For any household, housing affordability is a key to financial stability. Affordability means that, ideally, housing costs should not be more than about one third of your monthly income. For many with disabilities, low income can severely limit housing options.

If you are a first-time home buyer and meet income eligibility requirements, Movin’ Out can help with deferred or forgivable loans for down payments that reduce first mortgage debt for lower monthly payments, and lower the amount of cash you need for closing. Maximum purchase price limits apply.

Home buyer assistance programs

If you dream of owning your own home, Movin’ Out down payment assistance can help make mortgage payments affordable for income-qualified first-time home buyers with disabilities in many Wisconsin communities.

Outside the City of Madison, we can connect Dane County income-qualified home buyers with or without disabilities to housing counseling and mortgage reduction loans.

Home Buyer Education

Free classes for first-time home buyers

DUE TO COVID-19, OUR IN-PERSON PROGRAM IS

CANCELED UNTIL FURTHER NOTICE

To protect the safety and health of our community, Home Buyer Education Classes are canceled until further notice.

These organizations offer online classes:

Thank you for your understanding and patience.

Movin’ Out offers home buyer education classes to people exploring the purchase of a home. These classes are free and available to anyone. The classes meet the standards of most lenders who require home buyer education, including seven hours of classroom instruction and individual counseling with Movin’ Out’s HUD-certified housing counselors. Movin’ Out has adopted the National Industry Standards for Homeownership Education and Counseling.

Prepare for a successful home search and purchase experience. Learn from experts about credit, money management, down payment assistance, mortgage lending, real estate, home inspection, home insurance, and the closing process.

For more information, contact a Movin’ Out housing counselor at 608-251-4446 x7 or email: info@movin-out.org.

Home Repair

Making repairs and improvements for safety and accessibility

Movin’ Out helps income-qualified home owners with a family member with a disability plan and carry out repairs, improvements, and accessibility modifications that improve the health and safety of the home. We can help you arrange grants or deferred or forgivable loans to help pay for these expenses. A home repair loan can be used to fix a roof, repair or replace a furnace, build or repair a ramp, install handrails, and many other types of improvements.

Dane County Minor Home Repair Program

The Dane County Minor Home Repair Program provides eligible homeowners with a $5,000 grant that can be used to repair the owner’s home or to improve accessibility for people with disabilities.

Who is eligible?

Household income at 80% of county median or less.

A household member must have a permanent disability.

The home must be occupied by the owner as their primary residence.

Payments must be current on mortgage, property taxes, and homeowner’s insurance.

The assessed value of property being assisted must not exceed 95% of the area median purchase price.

The household must not have received assistance through the provision of a Dane County repair grant in the previous three years.

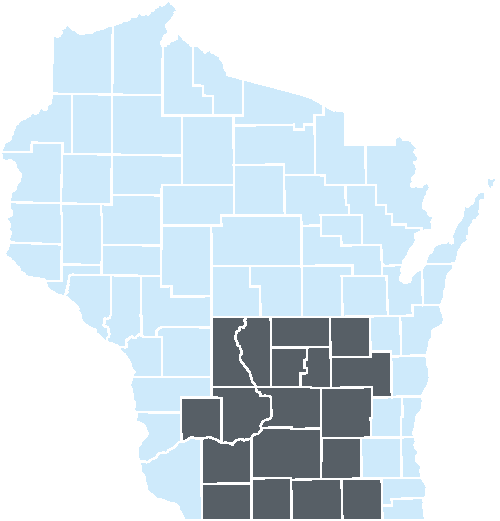

Home owners in counties colored gray are eligible for the Movin' Out home repair program.

Affordable Housing Program (AHP)

Home Repair Grant

The AHP Home Repair Program provides eligible homeowners with a grant that can be used to repair their home or to improve accessibility for people with disabilities.

This grant is available only to homeowners in these counties: Adams, Columbia, Dane, Dodge, Fond du Lac, Green, Green Lake, Iowa, Jefferson, Juneau, Lafayette, Marquette, Richland, Rock, Sauk, Walworth, Waushara, and Winnebago

Who is eligible?

Household income at 80% of county median or less.

A household member must have a permanent disability.

The home must be occupied by the owner as their primary residence.

Payments must be current on mortgage, property taxes, and homeowner’s insurance.